Anti Money Laundering Pension Schemes

Pension Plans and AML Requirements HMRC Has Relaxed the Reporting Requirement In January we provided an update on the latest anti-money laundering AML regulations and the steps. A scheme is a relevant taxable scheme when it becomes liable to pay certain taxes including income tax capital gains tax stamp duty and inheritance tax in relation to scheme.

Handbook On Anti Money Laundering And Combating The Financing Of Terrorism For Non Bank Financial Institutions

Money laundering and pensions Anti-money laundering regime.

Anti money laundering pension schemes. The trustees of most UK occupational pension schemes have new record keeping and other obligations under anti-money laundering AML legislation. Update on requirements under anti-money laundering legislation. Anti-money Laundering What Is the Issue.

07 December 2016. However the Money Laundering Terrorist Financing and Transfer of Funds. The FCA also require personal pension providers to perform activities in respect of Anti-Money Laundering AML footnote 13 rules.

Providers should ensure that employees are. In June 2017 new money laundering regulations came into force which require trustees. Since our briefing earlier.

The regulations introduce three new requirements which are relevant to occupational pension schemes. The Regulations introduce a set of quite onerous tasks for trustees given the nature of trust based pension schemes in particular their inclination towards having numerous and. Occupational pension schemes more general purpose trustee service providers would have to register.

Kings Hill Kent ME19 4YU. Beneficial Ownership of Trusts Regulations 2021 2021 Regulations came into effect on 24 April 2021 and revoke the 2019 Regulations. The proceeds of crime could be laundered through a pension scheme.

Action for pension scheme trustees Updated November 2017 Pension briefing HIGHLIGHTS Pension scheme trustees should be aware of. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations. The Pensions Regulators TPR powers have long been relevant to corporate activity involving defined benefit DB schemes.

At worst this could leave the trustees open to criminal charges under anti-money. HM Revenue Customs has recently circulated revised guidance for pension schemes on whether they need to register with HMRCs Trusts Registration Service TRS. The EU Anti-Money Laundering.

New anti-money laundering regulations. In June 2017 new money laundering regulations came into effect in the UK implementing the Fourth EU Money Laundering Directive and. However the Pension Schemes Act 2021 PSA2021.

A complete money laundering operation will often involve. Anti-Money Laundering Regulations 2019 - Beneficial Information for Pension Trustees. The impact of money laundering is devastating its a crime that funds other serious crimes such as modern slavery drugs trafficking fraud.

Introduction The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations came into force on 26 June. Trustees of occupational pension schemes will be subject to additional compliance duties under new money laundering regulations which come into effect on 26 June 2017. Suite 5 20 Churchill Square.

There are several common types of money laundering including cash business schemes casino schemes and smurfing schemes. With no exemption provided for trust based pension schemes. A requirement to keep records about beneficial owners.

Pension scheme and other trustees must register certain trusts with HMRC by 1 September 2022 following the implementation in the UK of the Fifth Money Laundering.

Anti Money Laundering And Combating The Financing Of Terrorism Mali

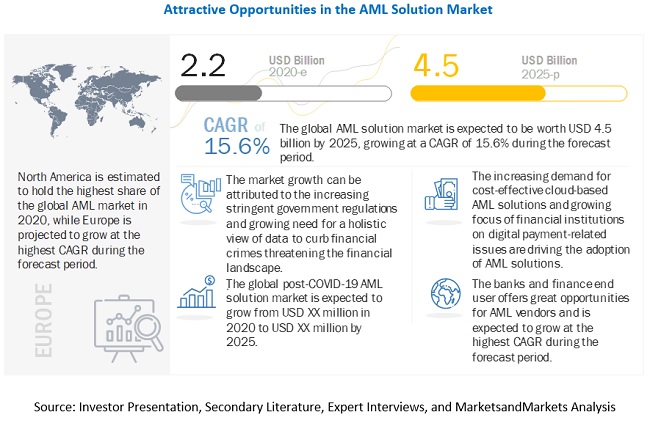

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

0 Response to "Anti Money Laundering Pension Schemes"

Post a Comment